In order to provide equal access and equal opportunity to people with diverse abilities, this site has been designed with accessibility in mind. Click here to view

Proposed Tax Cuts Will Devastate Oklahoma in Years to Come

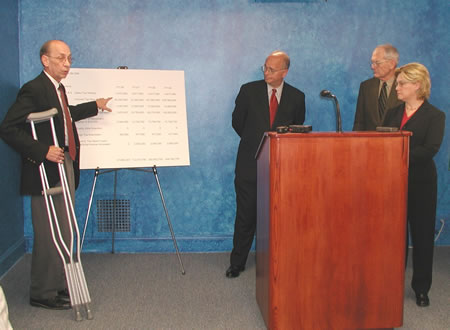

Senator Jim Wilson, Representative Debbie Blackburn and Representative Joe Eddins stated today that the current round of Oklahoma tax cuts being considered by both house of the legislature will only prove to be devastating to future programs and needs of Oklahomans.

The legislators stated that the tax cuts, which are phased in over a period of four years, seem like a good plan, but in the end will only end up costing Oklahomans more grief and problems.

“Every prosperous state in the nation has a great infrastructure. For Oklahoma to truly be a major contender in attracting more businesses and people, we need to invest in our infrastructure – such as our roads and bridges and invest more, not less in education. Overall, we need to enhance the quality of life for our citizens, not incrementally erode our tax base over the next four years,” said Wilson, D-Tahlequah.

The tax cuts will be phased in beginning in Fiscal Year (FY) 2006 and will reach their full potential in FY-09. The fiscal impact of the first phase is just under $58 million; however, the fourth phase of the tax cuts will have almost a half a billion dollar impact on Oklahoma’s agencies, programs, and education system.

“This TABOR-like tax proposal was instituted in Colorado and now their current governor, Bill Owens, has realized the huge mistake that has been made and is working to get as far away from the escalating tax cuts as possible,” stated Representative Blackburn, D-OKC. “We may not be Ezekiel, Isaiah, or Jeremiah, but as legislators we still have a prophecy to make and what these cuts will do is dramatically weaken education, infrastructure, public safety and other programs vital to every citizen in this state.”

The tax cuts include providing an income tax rate reduction – an impact of a little more than $42 million in the first phase and an impact of $220,560,000 in phase four – providing a capital gains extension, which will end up costing taxpayers $10.5 million along with many other cuts that will slowly erode Oklahoma’s tax base over the next four years.

Representative Eddins also noted that the idea of reducing the top tax bracket is no doubt the least attractive plan for economic expansion and begs the question of the value of supply side economics. “Our goal is to protect working Oklahomans and to build our state’s economy and infrastructure. Implementing these tax cuts will only cause a negative effect that will greatly impact Oklahoma in years to come,” said the Vinita Representative.

Eddins added, “Twelve years ago Oklahomans voted upon and approved to create a 10 percent income tax increase in HB1017. If we are going to institute major income tax cuts to go against the people’s will, then I believe we again need to let the people decide their fate.”

Senator Wilson concluded, “These cuts will occur no matter what happens to Oklahoma’s revenue collections. That means if our revenues stagnate or decline, we’ll be faced with either budget shortfalls which will have to be balanced on the back of our public schools and other critical programs.”

Oklahoma Senate

Oklahoma Senate